qyld stock dividend per share

Nasdaq 100 Covered Call ETFGlobal X Funds NASDAQ. QYLD tracks the performance of the CBOE Nasdaq-100 BuyWrite V2 Index and is a dividend ETF that deserves a place in your portfolio.

Qyld Avoid This Etf As A Long Term Investment A Review

Invesco QQQ Trust Exchange traded fund designed to correspond to the price and yield performance of the Nasdaq-100 Index which consists of the 100 largest non-financial companies listed on NASDAQ.

. I collect the dividends and buy new shares each month. Ad Free report details a dividend stock that pays out 12x per year 2 Bonus Stocks. How to Pick Value and Manage Stocks plus eight e-books specifically about dividend growth investing.

QYLD has a dividend yield of 1383 and paid 282 per share in the past year. The companies in the portfolio announce regular raises. And for good.

Looking at the chart above QYLDs low point in its 52 week range is 1943 per share with 2358 as the 52 week high point that compares with a last trade of 2077. Recall that QQQ is just the plain ol fund that tracks the NASDAQ 100 Index. Lets say you purchased shares of QYLD at 25.

See How Our Investing Approach Can Help Clients Balance Risk. View QYLDs dividend history dividend yield next payment date and payout ratio at MarketBeat. The investor keeps the 65 premium and his 100 shares of XYZ stock.

The Global X Nasdaq 100 Covered Call ETF NASDAQ. A quick search online. Is Global X NASDAQ 100 Covered Call ETF NASDAQQYLD a good stock for dividend investors.

The investor sells a call option for 110. Probably the safest choice is a low-cost fund that picks dividend stocks from the SP 500 stock index. QYLD on 01-21-2022 declared a dividend of 02030 per share Read more.

Global X NASDAQ 100 Covered Call ETF pays an annual dividend of 283 per share and currently has a dividend yield of 1358. There are three reasons that the DGPs dividend stream goes up every year. The indicated annual dividend rate and yield calculated from the latest dividend.

The current stock price is 100 per share. QYLD without dividend reinvestment. The option will be.

Unlike with most dividend payers the QYLD ex-dividend and payment dates are published a full year at a time. I have written one book on stock investing generally Sensible Stock Investing. JEPI has a dividend yield of 708 and paid 428 per share in the past year.

30 2021 DIVIDEND RATE DECREASE. The dividend is paid every month and the last ex-dividend date was Jan 24 2022. Company Bs share price is now 99 which has now grown by 10 to 10890.

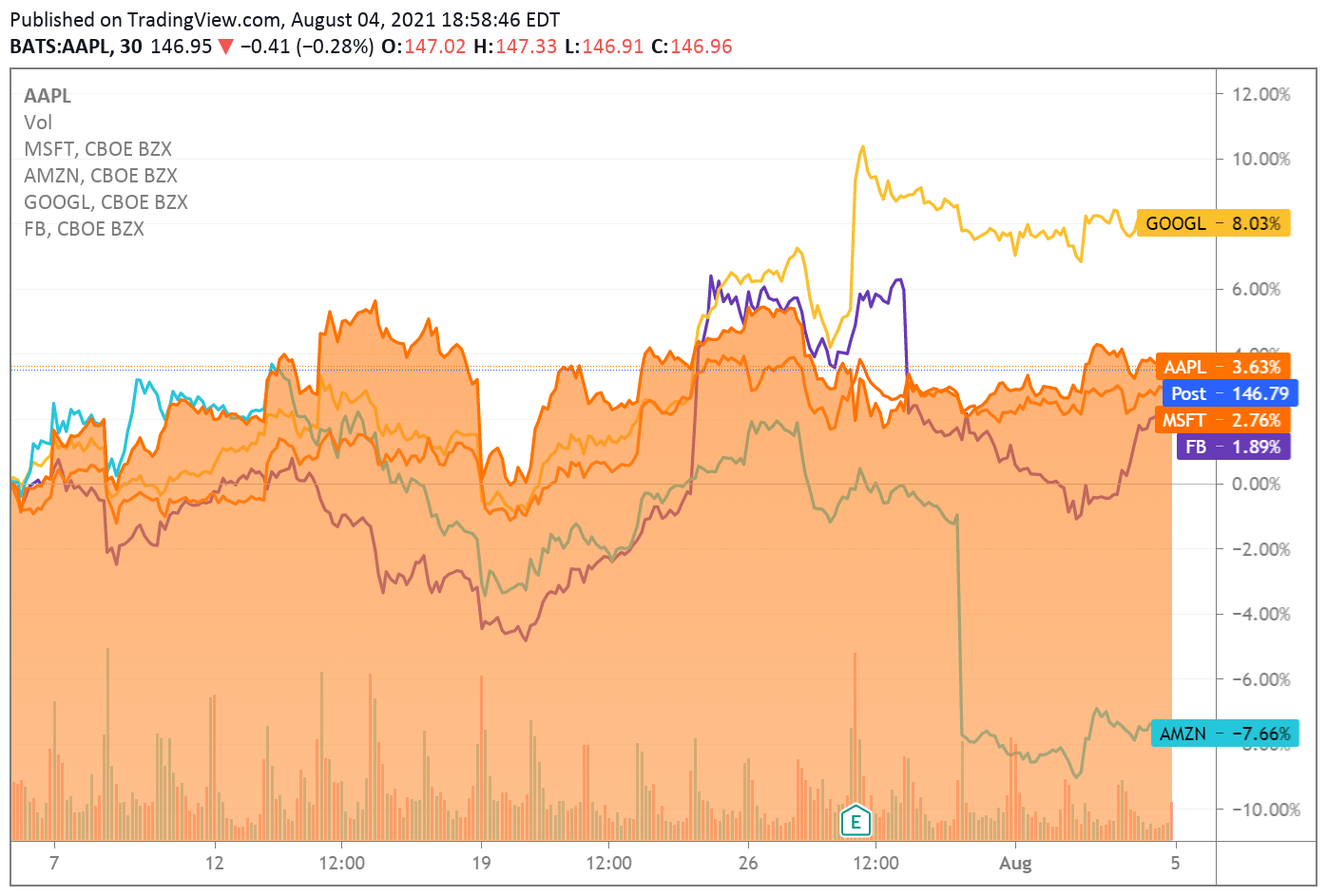

SP 500 441864 -190 DOW 3473806 -143 QQQ 34706 -317 AAPL 16864 -202 MSFT 29504 -243 FB 21955 -374 GOOGL. QQQ in terms of sheer performance. Yield is the amount of dividends paid per share divided by the closing price.

21 2022 DIVIDEND ANNOUNCEMENT. Ad Helping Clients Balance Risk and Pursue Sustainable Growth Income. After 1 month you receive 025 per share in dividends.

Assume the option premium is 065 or 65 per contract. At this point since were talking about dividends and price appreciation lets pause the discussion for a second to look at QYLD vs. Why the Portfolios Dividend Stream Grows Each Year.

Find the latest Global X NASDAQ 100 Covered Call ETF QYLD stock discussion in Yahoo Finances forum. Learn why dividend stocks have been one of the most successful wealth building investments. Ad Cabot expert on dividend stocks will tell you where to find them and what to look for.

The backtest below will hopefully. View Global X NASDAQ 100 Covered Call ETFs dividend history. Annual Dividend Yield.

Since 1988 it has more than doubled the SP 500 with an average gain of 2537 per year. Looking at a chart of one year performance below QYLDs low point in its 52 week range is 1943 per share with 2358 as the 52 week high point that compares with a last trade of 1995. The dividend rate is the portion of a companys profit paid to shareholders quoted as the dollar amount each share receives dividends per share.

If we use that number for an estimate of what the premium was for the position. The dividend is paid every month and the last ex-dividend date was Feb 1 2022. Annual Dividend Yield.

Beginning in 2008 I helped start what has become a large community of dividend growth investors on Seeking Alpha where I have more than 23500 followers. These returns cover a period from January 1 1988 through January 3 2022. The dividend rate is the portion of a companys profit paid to shareholders quoted as the dollar amount each share receives dividends per share.

XYZ stock trades below the 110 strike price and the option expires worthless. QYLD has a dividend yield higher than 75 of all dividend-paying stocks making it a leading dividend payer. Today you will also receive our.

That payout amounted to 3 billion. Dividend Growth 1Y na. QYLD on 12-30-2021 decreased dividend rate 3 from 258 to 000.

Lets suppose you also have 1 share of Company B which also has a share price of 100 and that Company B just paid you a 1 dividend that you chose not to reinvest but take as income. That offers a broadly diversified package of top US. Walking through the movements in Table 1.

The indicated annual dividend rate and yield calculated from the latest dividend. The ex-dividend date will be around the 20 th of each month. Company B also grew by 10.

Share your opinion and gain insight from other stock traders and investors. On a total return basis the dividend stock indexes would be expected to improve compared to the SP 500 but the SP 500 would still be a clear winner. Yield is the amount of dividends paid per share divided by the closing price.

Join 800000 investors in-the-know and get a morning e-briefing on market developments Zacks Bull Stock of the Day plus more. Buy this one dividend stock by Feb 28th to start collecting a 10 annual yield. XYZ rises above the 110 strike price.

Instead of having that 025 taxed instantly instead your cost basis of your shares drops to 2475 lowering by 025 your dividend payment. That payout amounted to 3 billion. Adding in your 1 dividend distribution you took equals 10990 for a total.

In addition payment is always on the Tuesday or Wednesday mostly Tuesdays closest to the end of the month. What I do know is an at the money call on NDX today has a midpoint price of 381 per share or 38100 per contract. Of interest to income investors Rio Tinto paid out a 185 per share special dividend in 2021s first six months.

The average is about 20 cents per share. Skip to main content. Nasdaq 100 Covered Call ETFGlobal X Funds NASDAQ.

Zacks Rank stock-rating system.

Qyld Avoid This Etf As A Long Term Investment A Review

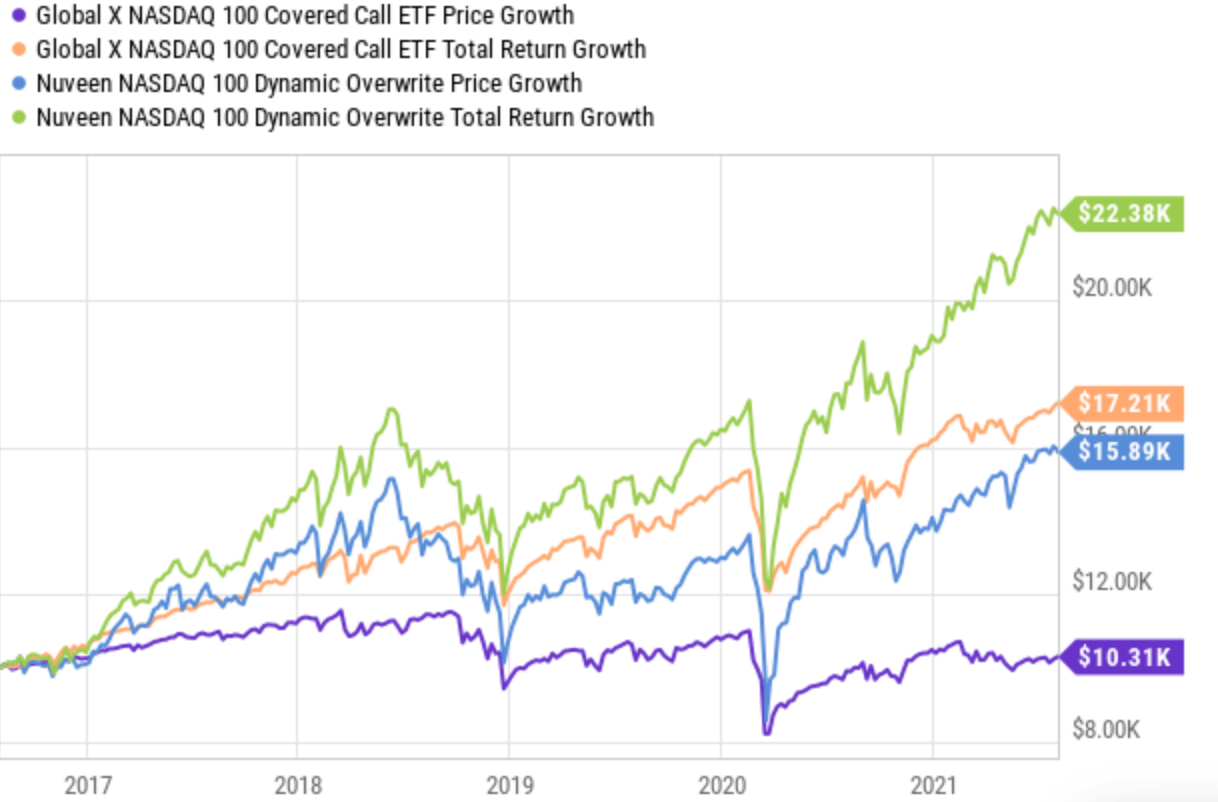

Pick This 7 9 Dividend Over This Flawed 11 8 Yield Nasdaq

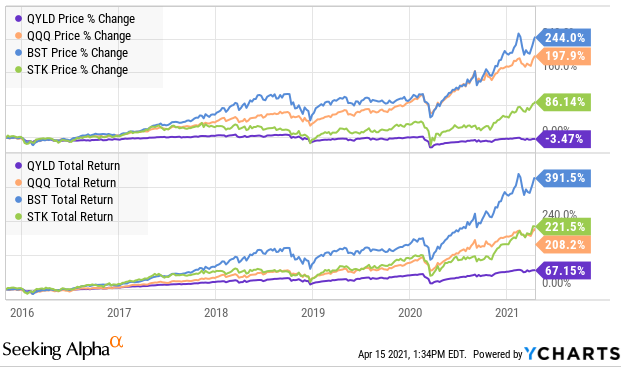

Qyld 12 Tech Yield But There S A Hidden Outperforming Alternative Nasdaq Qyld Seeking Alpha

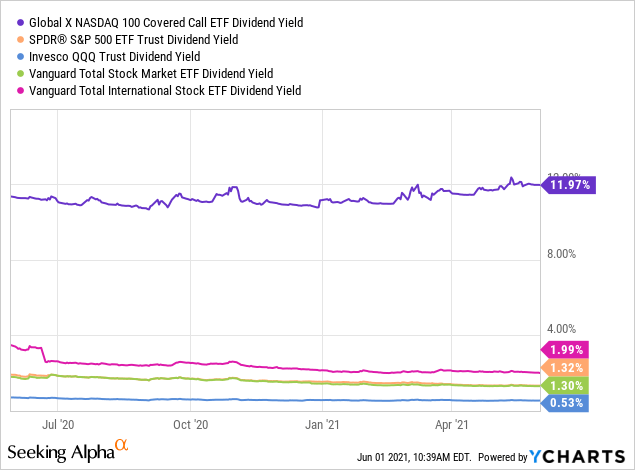

Qyld Time To Grab 11 86 Yielding Fund Before Tech S Next Run Seeking Alpha

Understanding Qyld And Its 12 Dividend Yield For Beginners By Project Theta Medium

Global X Nasdaq 100 Covered Call Etf Qyld Covered Call Etf 11 9 Yield Seeking Alpha

Don T Buy Qyld Buy These Cefs Instead Nasdaq Qyld Seeking Alpha

Dividend Growth Stock Of The Month For October 2021 Nasdaq 100 Covered Call Etf Qyld Dividends And Income

Understanding Qyld And Its 12 Dividend Yield For Beginners By Project Theta Medium