south dakota excise tax vs sales tax

Web The State of South Dakota officially became a Streamlined Sales Tax State on October 1st 2005. Web Find a variety of tools and services to help you file pay and navigate South Dakota tax laws and regulations.

South Dakota Sales Tax Breaks Consumers Pay While Big Businesses Get Exemptions

Contractors Excise Tax Guide Laws Relating to.

. Web South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. The municipalities of South Dakota have the authority to charge municipal sales.

In addition for a car purchased in South Dakota there are other applicable fees including. Web Sales Use Tax. The state also has several special taxes and local jurisdiction taxes at the city and county levels including lodging taxes.

Sales tax is imposed on almost all goods or services you purchase except the few mentioned above while. 4500 The state has reduced rates for sales of certain types. Web The South Dakota Department of Revenue administers these taxes.

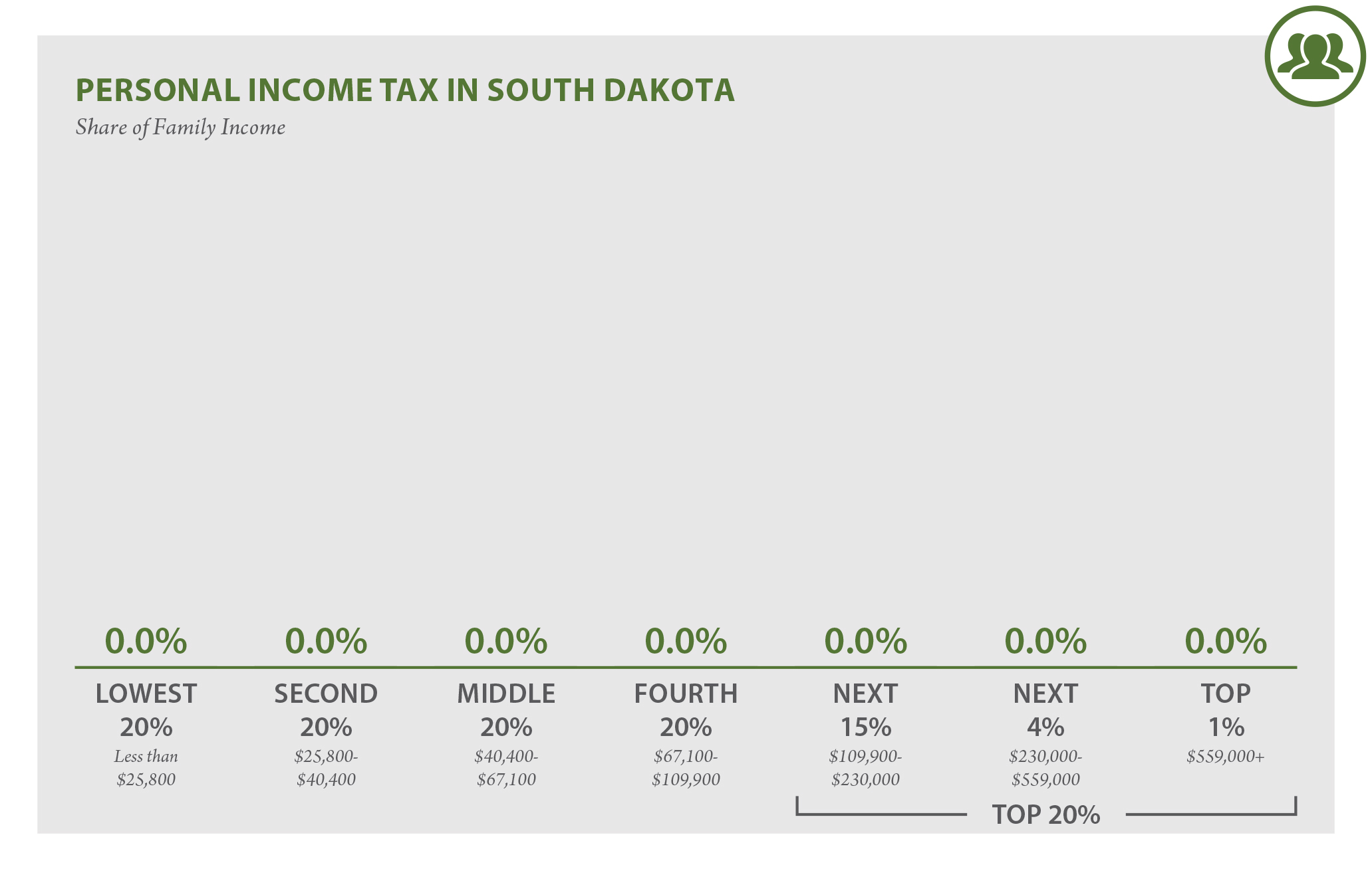

Web The South Dakota Department of Revenue SDDOR has updated its guidance on the sales tax implications of selling farm machinery. Web Average tax rates measure the overall share of income paid in taxes or the individual household or business tax burden. Web WHAT IS SALES TAX.

A single taxpayer with 45000 in gross. Web Exact tax amount may vary for different items. Web South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price.

State Sales and Use Tax Rate is 45 Municipal Sales and Use Tax Rate Up to 2 Applies to the gross receipts of the retail sale lease or rental of. Web Contractors Excise Tax Laws Regulations. South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles.

Counties and cities can. Taxpayer Bill of Rights. Web South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

Web South Dakotas sales and use tax rate is 45 percent. The guidance notes that all sales of farm. Web WHAT IS SALES TAX.

Sales and deliveries to certain Indian reservations are subject to the Tribal sales use and excise taxes in lieu of the state sales. The South Dakota Department of Revenue administers these taxes. The South Dakota Department of Revenue administers these taxes.

South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price. The State of South Dakota relies heavily upon tax revenues to help provide vital public services from public safety and transportation to health care and education. Web Sales Tax Exemptions in South Dakota.

See the contractors excise tax guide for more information about laws and regulations. The excise tax is reported as sales tax on the. Web South Dakota has a statewide sales tax rate of 45 which has been in place since 1933.

In addition contractors owe a 2 excise tax on the payments they receive for reality. Web Only the Federal Income Tax applies. Web There are four fundamental differences between sales and excise tax.

Web General tax revenues should come from more stable broad-based consumption taxes like the general sales tax imposed at the state-level on the retail sales of goods and services. With local taxes the total sales. Web Any person entering into a contract for construction services as defined in Division C of the Standard Industrial Classification Manual of 1987 or engaging in services that include.

North Dakota Cigarette And Tobacco Taxes For 2022

Ultimate Excise Tax Guide Definition Examples State Vs Federal

How High Are Spirits Excise Taxes In Your State

Updating Sales And Excise Taxes To Reflect Today S Economy Itep

South Dakota Sales Tax Revenues Keep Running At A Very Hot Pace

Motor Vehicles Sales Amp Repair State Of South Dakota

Sales Tax Laws By State Ultimate Guide For Business Owners

South Dakota Who Pays 6th Edition Itep

Sales Use Tax South Dakota Department Of Revenue

Understanding California S Sales Tax

Business State Tax Obligations 6 Types Of State Taxes

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

South Dakota Income Tax Form Fill Out And Sign Printable Pdf Template Signnow

South Dakota Income Tax Tax Benefits South Dakota Dakotapost

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online